What are institutional investors? Being an institutional investor means being part of a strategic ensemble composed of pension funds, insurance companies, hedge funds and mutual funds. Each entity plays a unique instrument, contributing to the symphony of institutional investing. This systematic approach involves pooling resources from various origins and strategically allocating them across various financial assets.

These influential entities, with their significant capital and expertise, hold the power to drive economic growth and mold financial landscapes. But what are institutional investors buying? Read on for more information.

What is an Institutional Investor?

Institutional investors are the backbone of the financial system, wielding substantial capital resources that significantly impact the global economy. The institutional investor definition refers to sophisticated participants that manage trillions of dollars in assets, giving them the power to move markets and influence the course of financial landscapes. With their fingers on the pulse of economic dynamics, institutional investors carefully analyze many factors when making investment decisions.

These include interest rates, inflation, GDP growth and corporate earnings. They identify opportunities that align with their investment strategies by scrutinizing economic indicators, market trends and sector performances. These analytical endeavors drive their ability to make informed choices that can sway the direction of market movements.

What is institutional investing? Beyond their role as financial powerhouses, institutional investors are influential stakeholders in the corporate governance of the companies they invest in. Their impact extends beyond balance sheets and profit margins. They can exercise ownership rights by voting their shares at shareholder meetings, nominating board members and engaging with management teams. This active involvement allows them to influence corporate decision-making, from strategic initiatives to sustainability practices.

Institutional investors' strategic approach includes a core objective: optimizing returns while managing risk, achieved through a carefully curated portfolio that spans various asset classes, industries and geographic regions.

Types of Funds Institutional Investors Manage

As strategic architects of their investment portfolios, institutional investors navigate a complex landscape of financial vehicles to achieve their diverse objectives. Within this intricate tapestry, they harness various fund types, each tailored to fulfill specific goals and capitalize on market opportunities. While there are hundreds of types and strategies for investment funds, let's look at the top 10 types of funds that institutional investors typically manage.

Pension Funds

As the cornerstone of retirement planning, pension funds secure future financial comfort for retirees. Employers and employees contribute to these funds, invested across a blend of assets. The aim is to balance growth and stability, ensuring members' retirement income needs.

Insurance Companies

Beyond safeguarding against risks, insurance companies are astute investors, leveraging premiums collected to generate income. Their portfolios encompass a strategic mix of stocks, bonds and money market securities, aligning with their dual purpose of claims coverage and sustainable operations.

Hedge Funds

Hedge funds are known for their diverse strategies aimed at delivering attractive returns. Their flexibility allows for leveraging and employing derivatives, while their exclusivity, catering to accredited investors, reflects the potential for higher rewards, albeit with commensurate risk.

Mutual Funds

Emblematic of collective investing, mutual funds pool resources from individual investors to create diversified portfolios. They offer various options, including equity funds focusing on stocks, bond funds targeting fixed-income securities and money market funds emphasizing stability.

Exchange-Traded Funds (ETFs)

ETFs merge the features of stocks and mutual funds and trade on exchanges, providing ease of liquidity. They mirror specific indices, asset classes or commodities, offering institutional investors a flexible means to track markets or segments of interest.

Real Estate Investment Trusts (REITs)

With a spotlight on real estate, REITs allow institutional investors to participate in income-generating properties without direct ownership. They encompass equity REITs, which own properties and generate rent income. Mortgage REITs focus on real estate debt, and hybrid REITs combine both approaches.

Commodity Funds

Acknowledging the importance of commodities, these funds offer exposure to vital resources like oil, gold and agricultural products. They hedge against inflation and provide diversification, contributing to a balanced portfolio.

Venture Capital Funds

Pioneering innovation, venture capital funds dive into the realm of early-stage companies with high growth potential. While inherently risky, these investments can yield substantial rewards, making them attractive options for those seeking innovation-driven returns.

Private Equity Funds

Distinguished by their investments in privately held companies, private equity funds adopt diverse strategies such as buyouts and restructuring to unlock value. They play a pivotal role in shaping the corporate landscape and driving growth.

Infrastructure Funds

Investing in the backbone of societies, infrastructure funds participate in projects like roads, bridges and power plants. Known for their stability and long-term income potential, these funds align with institutional investors' objectives of prudent risk management and consistent returns.

By deftly navigating these diverse fund types, institutional investors construct portfolios that reflect their unique investment philosophies and risk appetites. These funds' careful selection, allocation and management define their role as formidable forces in world markets.

Understanding What Institutional Investors Do

These financial behemoths act as key drivers, adeptly directing the flow of capital to craft cohesive and prosperous financial strategies.

Who are institutional investors? Institutional investors encompass diverse entities, each representing a distinct piece of the financial puzzle. From pension funds and insurance companies to mutual funds and investment banks, these entities manage vast pools of capital for individuals, shareholders and beneficiaries. When you invest in a mutual fund or contribute to a retirement plan, you become a part of this intricate symphony of investment.

At the heart of their operations lies the art of institutional investment management. This involves systematically allocating resources across a spectrum of financial instruments. The goal is to optimize returns while managing risks, ensuring a delicate balance between capital appreciation and stability. Institutional investors navigate the intricate financial market landscape, diligently analyzing economic indicators, market trends and sectoral performances.

Their goal? To identify opportunities that align with their investment strategies. Like a skilled navigator charts a course through uncharted waters, these investors strategically allocate funds to various assets, from stocks and bonds to real estate and commodities.

How does this impact the broader financial ecosystem? Institutional investors are more than mere participants; they are the architects of market dynamics. Their sheer volume of trading activity shapes the ebb and flow of asset prices, driving trends and influencing economic growth.

These investors constitute a significant portion of trading volume on stock exchanges, exerting a profound influence on price movements. Beyond trading, institutional investors wear the hat of institutional shareholders. As major corporate stakeholders, they hold the power to influence corporate governance. They impact critical decisions through voting rights and active engagement, such as electing board members or advocating for strategic shifts. Their voice resonates within the boardrooms, influencing the direction of the companies they invest in.

An interesting facet of institutional investing lies in its substantial buying power. Institution investors work for financial powerhouses like Morgan Stanley and other major financial institutions. Unlike individual investors, who often trade in limited quantities, institutional investors can execute large-scale transactions. This ability affects supply and demand dynamics and contributes to their role as market movers. Institutional investors also wield a significant degree of ownership in various securities.

Their portfolios encompass diverse assets, ranging from stocks to bonds and beyond. This diverse ownership allows them to diversify risk and capitalize on emerging opportunities.

The work of an investment institution is as diverse as the financial instruments they manage. Pension funds secure retirement savings, while insurance companies manage capital to cover claims and generate income. Mutual funds pool resources from numerous investors, creating a collective force in the market. Investment banks facilitate capital raising, bridging the gap between businesses and financial markets. These are just a few examples of the multifaceted roles that types of institutional investors embody. Large institutional investors stand out as giants of the financial realm among the diverse array of institutional investors. Their massive capital reserves enable them to execute transactions of monumental proportions, influencing price movements and shaping market trends.

Institutional investors are the architects of the financial landscape, strategically maneuvering capital, shaping market dynamics and influencing economic growth. Their role extends beyond transactions; it profoundly impacts the global economy. As you learn more about the world of investments, understanding the role and significance of institutional investors is essential to making informed financial decisions.

How Institutional Investors Impact Markets

Institutional investors wield enormous sway over financial markets. These powerhouses are not mere spectators but dynamic players facilitating market movements, reshaping landscapes and driving economic currents.

Institutional investors are akin to catalysts, propelling markets into new directions. Their considerable trading volume, often accounting for more than half of total market activity, exerts significant pressure on stock prices and trading patterns.

Imagine a scenario where institutional investors collectively decide to invest heavily in a particular sector, such as technology. Their substantial buying power can send stock prices soaring, attracting attention and igniting a bullish trend. Similarly, if they choose to offload significant holdings, the resulting selling pressure could lead to market downturns. Institutional investors often act as trendsetters, leading the way into and out of market trends. Their decisions to enter or exit specific sectors can set the tone for market sentiment, influencing individual and retail investors. This capacity to anticipate and respond to shifts in market sentiment grants them a proactive role in shaping market movements.

The impact of institutional investors does not affect equity markets alone. Their influence extends across various asset classes, from fixed-income securities to real estate and commodities. They allocate resources strategically and contribute to liquidity, volatility and overall market stability. Beyond market dynamics, institutional investors exert a notable influence on corporate governance. Their significant institutional ownership of shares grants them voting rights and a platform to influence key corporate decisions, such as electing board members or supporting shareholder resolutions.

The collective actions of institutional investors contribute to economic stability and growth. By directing capital to industries and sectors with potential for expansion, they fuel innovation, job creation and overall economic prosperity. Their actions can amplify or mitigate market fluctuations, offering opportunities for profit or prompting caution. Monitoring institutional investor behavior, analyzing their moves and aligning your strategies can provide valuable insights into market trends.

During market volatility, institutional investors can play a pivotal role in restoring stability. Their ability to allocate resources strategically, coupled with their long-term investment horizon, can contribute to market resilience by absorbing shocks and instilling investor confidence. Over the past few decades, institutional investors have played pivotal roles in shaping significant market events. Their impact on these events highlights their capacity to drive market movements and influence global financial landscapes:

- 2008 financial crisis: The 2008 financial crisis exemplifies how institutional investors can sway markets. Heavily invested in mortgage-backed securities, these investors suffered substantial losses as the housing market crumbled. This triggered a cascade of sell-offs, plunging the stock market into turmoil. Notable stocks like Lehman Brothers and Bear Stearns took a hit, underscoring the profound consequences of institutional investment decisions.

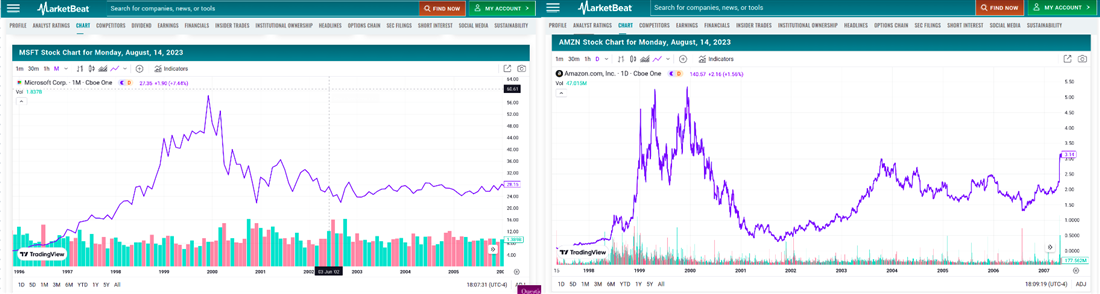

- Dot-com bubble and burst: In the late 1990s, institutional investors were central figures in the dot-com bubble's rise and fall. Their investments in technology stocks fueled the bubble's soaring valuations. Yet, when the bubble burst in 2000, institutional investors faced the necessity to sell their tech holdings, triggering another significant market sell-off. Stocks like Amazon.com Inc. NASDAQ: AMZN and Microsoft Corp. NASDAQ: MSFT bore the brunt of this unraveling.

- COVID-19 pandemic resilience: The unprecedented challenges posed by the COVID-19 pandemic in 2020 showcased the adaptable nature of institutional investors. Initially cautious, these investors eventually reentered the market, helping stabilize it as the economic recovery gained momentum. Stocks like Apple Inc. NASDAQ: AAPL and Walmart Inc. NYSE: WMT benefitted from institutional investment decisions that played a pivotal role in preventing a major market crash.

- Rise of passive investing: Recent years have witnessed institutional investors catalyzing the surge of passive investing, a strategy centered on index funds and ETFs. The appeal of cost-effectiveness and ease of management has driven this shift. As institutional investors embrace passive investing, stocks like Tesla Inc. NASDAQ: TSLA and Netflix Inc. NASDAQ: NFLX have experienced upward price pressure, reshaping market dynamics.

- Derivatives and market swings: Institutional investors' strategic utilization of derivatives introduces a distinct dimension to market dynamics. These financial instruments, which derive value from underlying assets, are employed to speculate on market directions and mitigate risks. The use of derivatives has contributed to remarkable market fluctuations, such as the 2010 flash crash and the 2020 COVID-19 crash, emphasizing institutional investors' role in shaping market volatility.

Embracing the Wisdom of Institutional Investors

Now that you know the definition of institutional investor and the deeper institutional investors meaning, institutional investors' insights and strategies are valuable resources that can empower your investment journey. By delving into their role, analyzing their choices and adopting their methods, you can equip yourself with the tools to make well-informed decisions and develop institutional investment solutions that shape your financial future.

Recognizing the dynamic interplay between institutional and individual investors allows you to position yourself advantageously within the ever-changing landscape of financial markets. Whether you align your approach with institutional investment trends, adapt their strategies to your goals, or forge a unique path, their wisdom guides you to navigate complexities confidently. Remember, the choice is yours to make – integrating the principles of institutional investors into your investment journey provides an opportunity for discovery, education and growth, ultimately enhancing your potential for financial success.

Before you consider Amazon.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amazon.com wasn't on the list.

While Amazon.com currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.