If you've ever traded stocks intraday, you will likely use a margin trading account. Margin trading, meaning buying securities using borrowed funds, enables you to make unlimited trades up to four times your capital during market hours. It also lets you short-sell stocks.

However, like a double-edged sword, using margin in stock market trading is a weapon that can also wound you and your account. This article will deeply dive into margin accounts and trading on margin. We'll review the benefits and the pitfalls to make you better aware of this powerful resource and how to use it prudently with your trading.

What is trading on margin? Margin is the money an investor borrows from a broker to purchase an investment. Learn more about trading on margin.

What is margin trading?

Buying on margin definition is to use borrowed funds from your brokerage for your purchase. The amount borrowed is a margin loan. Margin trading involves borrowing funds to buy, sell, or short a stock through a margin-enabled brokerage account. To trade on margin, you must open a margin account with a brokerage firm and request that the account be margin-enabled.

What is a margin account, you ask? A margin account is an account that lets you borrow money to purchase securities. A margin account lets you make large trades with less of your own money. However, using margin in stock means you're taking on debt, additional costs, and with it, much more risk.

The minimum deposit to open a margin account will be subjective to your brokerage. It's common for brokerages to open a margin account by default unless you request a cash account. Brokerages also commonly require a minimum deposit of $2,000 in cash or at least $4,000 in securities to open a margin account.

Even if you don't need to use margin because you only buy stocks using your existing capital, a margin account will enable you to place trades immediately after you sell your position. A brokerage account that doesn't have margin enabled is called a cash account. A cash account requires waiting until the trade settles before using the cash from a sale for another trade. Trade settlement can take up to two business days, also called T-2.

Margin accounts are required if you perform short selling or short stocks. Short selling requires borrowing stock from a clearinghouse, which loans you the shares from its customer accounts. You are selling the borrowed shares first, hoping to buy them back at a lower price and keep the difference as a profit or loss if the stock rises against your short sale price. You are, in essence, borrowing stock you don't own with borrowed funds. Even if you short the capital in your account, the margin is required as collateral if the stock moves against you, incurring losses.

The Federal Reserve Board created Regulation-T (or Reg T) rules to manage the risks that brokerages and financial markets absorb when extending credit for stock trades.

Ret-T is why retirement accounts can't have or use margin. Margin accounts adhere to Reg-T, which requires trades to settle in two days. Individual retirement accounts (IRAs) or 401Ks are like cash accounts. Additional regulations discourage short-term trading with a retirement account since they are created for a long-term investment horizon.

You will be paying interest when you use the margin. That interest is based on an annual interest rate, so the daily accrual rate can be small and insignificant if you are trading intraday. The margin interest can add up if you decide to hold a position using margin overnight or swing it for days to weeks. It's usually collected from your account at the end of the month automatically or added to your margin balance. You must be aware of this, as it can form a compounding effect that adds up over time.

How does margin trading work?

Once you open a margin trading account, you can generally have 4:1 buying power on your capital. This buying power means if you have $30,000 in your margin account, you can typically buy up to $120,000 worth of stock. However, it also depends on the stock, as each broker will have maintenance margin requirements for volatile stocks. Some stocks may only allow you 2:1 buying power due to volatility.

The 4:1 is the minimum maintenance margin requirement the U.S. Financial Industry Regulatory Authority (FINRA) sets. However, brokerage requirements are subjective to their risky controls and policies. It's common to have maintenance margins higher than 25% on select stocks and up to 100% on the most volatile equities. It's common to use margin in the stock market.

You must know your buying power and maintenance margin for the stocks you trade on margin. It's also crucial to understand that some stocks will enable less buying power, and some stocks will be able to be purchased on margin. These stocks are usually very volatile for the day, or the overall market may be very volatile. Maintenance margin requirements can change intraday.

When day trading on margin, a typical stock will require 25% capital to trade, giving you 4:1 buying power. This lets you buy $100,000 worth of stock for $25,000 in capital. However, you never want to use all your margin, so you can't leave some wiggle room if the stock moves against you. It sounds simple enough if you take a single margin position. But it gets more complicated if you take multiple margin positions and have to monitor the maintenance margin on each stock throughout the day.

The maintenance margin is the minimum amount of equity you must maintain in your trading account after taking a margin position. Trading options on margin is also possible but must adhere to maintenance margin requirements. Investing on margin can be expensive and eat away at returns if you hold a position long-term, which isn't a wise decision. You should keep trades on margin to a short-term horizon. Be careful investing in margin.

Example of buying on margin

Here's an example to help you understand buying on margin. This starts by understanding what is a margin position.

Let's assume you have $30,000 in your margin trading account and want to buy 500 shares of XYZ stock. XYZ stock is trading at $100. To buy 500 shares at $100 would require proceeds of $50,000. You have $30,000 cash in your account and must borrow the other $20,000 for the position. If the brokerage extends the full 4:1 intraday margin or a 25% initial margin requirement for the position, you have $120,000 worth of buying power for the stock. This $120,000 contract is your margin position.

You could purchase 1,200 shares at $100 but always want to leave extra buying power if the position moves dramatically against you. For the 500 shares, you would borrow $20,000 from the brokerage on margin to acquire the 500 shares of XYZ at $100 per share. The calculations are done, and the margin is extended to your trade automatically and instantaneously. Once you have filled your order and opened the position of 500 shares at $100 per share, it's key to ensure your position in margin stock doesn't trigger a margin call.

What is a margin call?

A margin call is a demand from the brokerage to add more funds into your margin account to meet the maintenance margin requirement. A margin call occurs when your margin account value exceeds the brokerage's required maintenance margin amount. When you use margin and borrow funds for your trades, your account needs a minimum maintenance margin amount to stay above. You will be required to take action when the value falls below it.

Taking action on a margin call requires you to deposit more funds or securities into your trading account or sell some of your positions, which returns some borrowed funds to bring the account back up through the minimum amount threshold. Margin calls are no joke and shouldn't be ignored. If the brokerage doesn't get an action from you soon, they have the right and can initiate a forced liquidation, which automatically sells your positions to raise funds. This liquidation is programmed into the trading platform and can happen automatically depending on how deep you fall under your required fund value amount. Sometimes, forced liquidations can happen just minutes after your fall below the maintenance margin for highly volatile stocks that may be in a short squeeze.

An influx of margin calls perpetuates short squeezes as short sellers rush to buy to cover their positions, driving the stock price. Forced liquidations are indiscriminate and will automatically buy cover at market prices, further propelling shares higher and triggering more margin calls and short covering. It's a vicious process that can and has blown out trading accounts and hedge funds. The meme stock mania of 2021 was notable for numerous short squeezes that raised stock values by triple-digit percentages, led by the short squeeze in GameStop Corp. NYSE: GME.

How to get started margin trading

First and foremost, you will have to select a broker and open a margin trading account. Suppose you are planning on being an active trader. In that case, it's worth looking into brokerages with active trading platforms, charting tools, access to electronic order books, and level 2 trading windows with point-and-click order entries. Less active traders can consider some of the app-based zero-commission brokers. Either way, it's important to be aware of your trade margin.

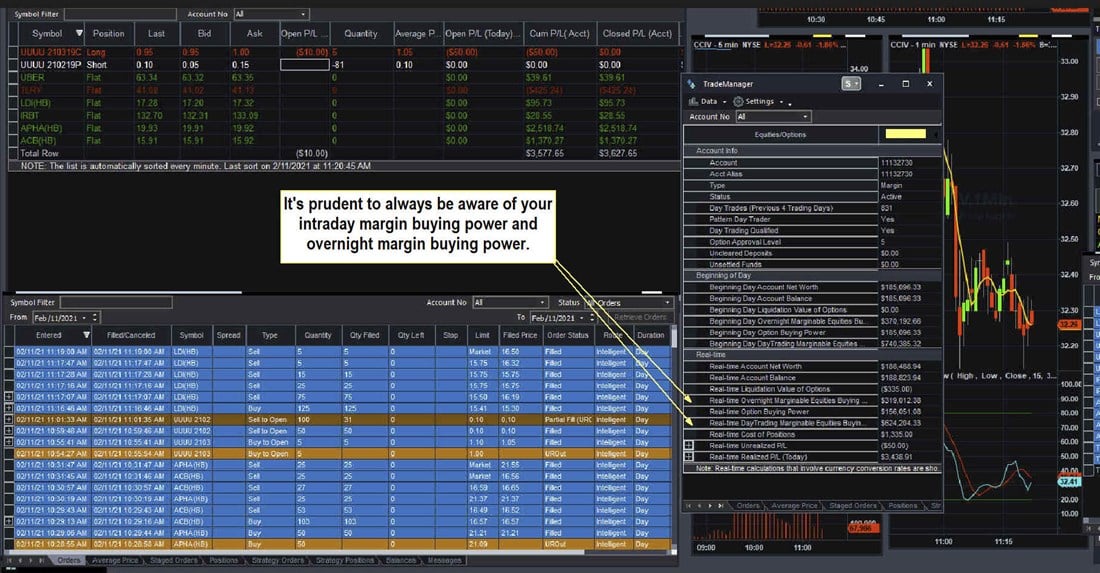

Active trading platforms have more charting and trade execution tools. Monitor your intraday and overnight buying power, determined by your margin. These will change in value as your positions change and as you place trades. Remember that just placing limit orders will use buying power even if you don't get the trade filled. You can configure many active trading platforms to limit your number of shares or position values to make it easier to avoid margin calls. If a margin call is triggered, the brokerage will notify you through the platform, messaging or email. Don't ignore it.

Remember that not all stocks qualify for a margin loan. While you can likely trade penny stocks in your margin trading account, brokerages don't usually allow for margin trading in penny stocks. If you use margin to short sell a dividend-paying stock, be aware that you will be responsible for paying the dividend to the lender of the stock you borrowed to short. This payment is done automatically in your trading account, so be aware of ex-dividend dates.

What is a pattern-day trader?

Every brokerage must identify or flag pattern day traders (PDT). Pattern day traders are accounts that place more than three round trip trades in a rolling five business day period. In a round-trip trade, you buy and sell the same stock position intraday. For example, buying 200 shares of XYZ at 10:15 a.m. and selling 200 shares of XYZ at 11 a.m. constitutes a round trip.

The PDT rule is controversial because it was created after the 2001 internet bubble to protect investors from overtrading stocks and blowing up their accounts. It discourages day trading and encourages holding positions, which can be brutal in a bear market. Many pundits argue that the rule doesn't protect but restricts smaller traders from exiting losing positions, forcing them to hold overnight rather than take a stop loss. It also causes traders to look for other riskier trading instruments and alternatives to trade that don't have a PDT requirement, like highly leveraged products like currencies, commodities, and futures or unregulated cryptocurrencies. In this sense, the PDT rule has the opposite effect. Since offshore trading accounts aren't subject to PDT rules and aren't regulated by the SEC or FINRA, smaller traders have migrated to offshore brokers to bypass them. Unfortunately, the commissions are high, and many fly-by-night scam brokers can run off with your money with little repercussions.

What are the margin requirements for pattern-day traders?

Just because you have a margin account doesn't mean you can make unlimited trades. Unfortunately, the pattern day trader (PDT) rule requires a minimum of $25,000 in your margin account to make more than three round trips in a rolling five-business-day period. If you are flagged and violate the PDT rule, your account can be suspended after the first violation for 90 days.

Most brokerage platforms will alert you when you may trigger a PDT violation if you have less than the required $25,000 capital in your margin trading account at any point in time. If you violate the PDT rules and make a fourth trade with an account under the $25,000 minimum, the brokerage can warn you on the first offense at their discretion. However, a second violation will result in a 90-day trading suspension in your margin trading account. During this time, you can only liquidate positions but not open new ones.

Pros and cons of margin trading

Here are some of the pros and cons of trading using margin.

Pros

Here are some benefits of margin trading:

- More buying power can result in higher returns. More buying power with margin means deploying less capital for the same returns. For example, if you buy 1,000 shares of a $100 stock with $25,000 in your margin account and sell the position when it rises 10% to $110, you make a $10,000 profit. The profit of $10,000 is 10% of the $100,000 cost or a 10% return on the $100,000 capital. However, since you only had to put up $25,000 for the 4:1 buying power, your actual return on the $25,000 invested would be 40%.

- Leverage enables the ability to trade higher-priced stocks. Margin accounts grant you the ability to play higher-priced stocks. Higher-priced stocks tend to get more volatility, volume and liquidity, especially if they are components of a benchmark index like the S&P 500 index. Conversely, higher-priced stocks move in bigger price ranges but can be proportionate percentage-wise. For example, a $30 stock can rise 5% to $31.50, but a 5% move on a $200 stock would be $10. Playing the shares on a $1.50 underlying price move versus a $10 price move would result in more significant gains.

- Margin trading allows short selling. Short selling can only be performed in margin trading accounts. The stock must be borrowed for you to short-sell, and the margin is used as collateral if you don't return the shares.

Cons

Here are some of the downsides to trading on margin:

- Margin calls can blow out your account. The fastest way to exit the trading business is to blow out your account. Long positions on margin can trigger margin calls if the stock suddenly collapses on a weak earnings report or a position that you can't sell for a loss. However, short positions can blow out your account if it has a huge short squeeze, especially if there are no more available shares to borrow. With more leverage and buying power comes the potential for amplified losses.

- Interest and fees can add up. Holding positions on margin can result in large and compounding interest charges over time. Margin is not free as it comes with interest charges. Borrowing shares to short can also come with locate fees and higher interest rates.

- Potential for large debt. If you can't meet the margin calls and the position goes wildly against you, taking your position into the negative, you will incur debt to pay back the brokerage. It's possible to have a negative balance even after a forced liquidation of your positions for a margin call. That negative balance is a debt you'll have to pay back or face collection agencies and debt collectors, not to mention a sinking credit score.

Trading on margin: Understand the ins and outs

Margin trading provides leverage on higher-priced stocks. Margin can help you optimize profits, but it can also put you in money jeopardy. Monitor and maintain your maintenance margin requirements to avoid margin calls.

Before you consider GameStop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GameStop wasn't on the list.

While GameStop currently has a "Sell" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.