Blue chip (or blue-chip) stocks, known for their stability and reliability, represent established, financially sound companies in well-established industries. They're the cornerstone of many portfolios, attracting long-term investors seeking consistent returns.

Understanding how to invest in blue chip stocks involves identifying these top-tier companies renowned for their solid financials, consistent dividends and enduring market presence. Investors often seek guidance by asking "What are the top blue chip stocks?" and "How to buy blue chip stocks." If you're interested in investing in blue chip stocks, you must first take the time to understand them. Let's take a few minutes to dig into blue chip stocks to determine if they suit your portfolio.

Understanding blue-chip stocks

What are blue chip stocks? Blue-chip stocks typically belong to well-established companies with robust financials, enduring market presence, and strong brand recognition.

What is a blue chip company? The criteria defining a stock as a "blue chip" often include consistent revenue streams, reliable cash flow and a history of paying dividends.

Are blue chip stocks a good investment? Investors are attracted to blue-chip stocks because of their perceived lower risk than other investments. Blue-chip companies are typically in defensive industries with a history of consistently demonstrating resilience during economic downturns.

Blue-chip stocks often outperform other stocks during economic downturns. That's one reason investors seeking regular income and long-term gains invest in blue chip dividend stocks. These dividend-paying stocks frequently maintain dividends even in challenging times.

Some prominent examples of blue-chip stocks include stalwarts like Johnson & Johnson (NYSE: JNJ), known for its resilience and consistent dividend payouts and The Coca-Cola Company (NYSE: KO), renowned for its enduring global brand and market presence. These companies have sustained their status as blue-chip stocks by exhibiting the characteristics investors seek: stability, long-term performance and reliability.

Investors can find attractive blue-chip stocks in various industry sectors. In the tech sector, investors often ask, "Is Amazon a blue chip stock"? It is, and it's not alone. Tech giants like Amazon (NASDAQ: AMZN), Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL) are widely considered blue-chip stocks due to their innovation and market leadership.

However, companies in sectors like consumer goods, such as Procter & Gamble (NYSE: PG) and the finance sector's JPMorgan Chase (NYSE: JPM), also hold a prominent position among blue-chip stocks for their established market presence and financial robustness. These examples show you the diverse landscape of blue-chip stocks and their consistent performance, reinforcing their reputation as low-risk investments and validating their appeal to investors.

How to choose the right blue-chip stocks

Choosing the right blue-chip stocks demands a strategic approach aligned with individual financial objectives. It is not as simple as asking, "What are the top blue-chip stocks?" and then investing your money. Thorough research serves as the cornerstone of this selection process. Investors should research the company's financial statements and earnings call data, assessing key metrics such as revenue growth, cash flow stability, and dividend history.

Understanding market trends and the company's position within its industry is crucial. Identifying market leaders, examining their competitive advantages and evaluating growth prospects aid in choosing stocks with long-term potential.

Diversification within the blue-chip category is essential for a balanced portfolio. Allocating investments across different industries and sectors mitigates risks associated with market volatility. This approach ensures your portfolio isn't overly reliant on a single sector's performance, enhancing stability and resilience during market fluctuations.

Moreover, considering the broader economic landscape and global market conditions can guide investors in selecting blue-chip stocks that align with their risk tolerance and investment horizon. By implementing a well-researched, diversified strategy, investors can build a robust portfolio of blue-chip stocks tailored to their financial goals and risk appetite.

How to invest in blue-chip stocks

Investing in blue-chip stocks demands a strategic approach and a meticulous understanding of market dynamics. Let's break down the steps to guide you through this investment process:

Step 1: Define your investment goals.

Defining your investment goals is the fundamental cornerstone of any investment strategy. This pivotal step demands a comprehensive evaluation of one's financial aspirations, risk appetite, and the desired outcomes from the investment venture. Planning at this stage necessitates introspection into your long-term financial objectives, be it capital appreciation, regular income, or a balanced blend of both.

Articulating clear investment goals outlines the trajectory of your financial endeavors and acts as a guiding beacon amid the thousands of available investment avenues. Assessing one's risk tolerance stands as a pivotal facet within this step.

You must understand how comfortable you are with market fluctuations or potential uncertainties. Additionally, aligning these investment objectives with the stability and reliability offered by blue-chip stocks unveils whether these stocks harmonize with your overarching financial strategy, paving the way for a well-informed and tailored investment approach.

Step 2: Research and identify blue-chip stocks.

Conduct extensive research to identify blue-chip stocks across diverse industries. Look for companies with solid financials, consistent dividend payments and a history of market resilience.

Step 3: Analyze financial statements.

Research the financial statements of selected blue-chip stocks. Assess key metrics such as revenue growth, profit margins, debt levels and dividend history. This analysis aids in evaluating the stability and growth potential of these companies.

Step 4: Consider market trends and industry position.

Evaluate the market trends and the competitive position of these blue-chip companies within their respective industries. Look for firms demonstrating market leadership, innovation and long-term growth potential.

Step 5: Diversify your portfolio.

Allocate investments across different blue-chip stocks and industries. Diversification mitigates risks associated with individual stocks or sectors, ensuring a well-rounded and resilient portfolio.

Step 6: Determine entry and exit points.

Identify favorable entry points based on your research, the market conditions and valuation metrics. Additionally, establish exit strategies or criteria for reevaluating investments periodically.

Step 7: Monitor and adjust your portfolio.

Regularly monitor the performance of your blue-chip investments. Stay informed about financial updates, industry shifts and broader market trends. Adjust your portfolio as needed to align with evolving market conditions.

Step 8: Review allocation strategies.

Periodically review your allocation strategies, considering the role of blue-chip stocks in your broader investment strategy. Assess whether adjustments are needed to maintain a balanced and diversified portfolio.

Investing in blue-chip stocks is a long-term endeavor that requires patience, thorough analysis and a proactive approach to portfolio management. Incorporating these steps can help you navigate the complexities of the market and build a robust portfolio tailored to your financial objectives.

Pros and cons of investing in blue-chip stocks

Investing in blue-chip stocks offers a mix of advantages and considerations for investors. Let's explore the pros and cons of incorporating these stocks into your investment portfolio.

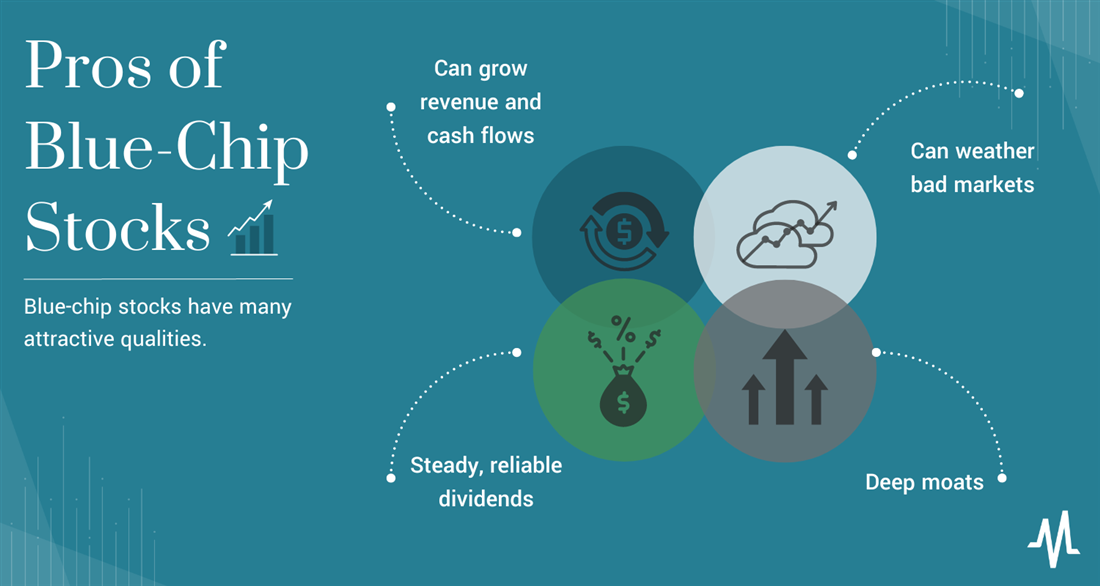

Pros of blue-chip stocks

Blue-chip stocks come with several compelling advantages:

- Reliable dividend payments: Many blue-chip stocks have a history of consistent dividend payouts, providing investors with a reliable income stream. These dividends often grow over time, making them appealing for income-oriented investors.

- Potential for capital appreciation: While known for stability, blue-chip stocks also offer the potential for long-term capital appreciation. These companies tend to have enduring growth potential, contributing to wealth accumulation over time.

- Hedge against market volatility: Blue-chip stocks often exhibit resilience during market downturns. Their stability and strong market positions can act as a hedge against broader market volatility, providing stability to a portfolio during turbulent times.

Cons of blue-chip stocks

However, investing in blue-chip stocks also presents some challenges and risks:

- Limited growth potential: Blue-chip stocks, while stable, might have limited growth prospects compared to smaller, high-growth companies. Their size and market saturation can sometimes hinder rapid growth, impacting potential capital gains.

- Vulnerability to economic downturns: Blue-chip stocks are not immune to economic downturns despite their stability. Changes in economic conditions or industry-specific challenges can affect their performance, leading to temporary setbacks.

- Market saturation and valuation concerns: Some blue-chip stocks might face challenges due to market saturation, leading to high valuation multiples. Elevated valuations could potentially limit future returns and increase risk.

Mitigating the risks of blue-chip stocks

To mitigate risks associated with blue-chip stocks:

- Diversification: Spread investments across various sectors and asset classes to reduce overexposure to any single stock or industry.

- Regular monitoring: Continuously monitor the performance of blue-chip stocks and stay informed about industry trends and market conditions to make informed investment decisions.

- Long-term perspective: Adopt a long-term investment horizon when investing in blue-chip stocks, understanding that short-term market fluctuations may not impact their overall performance significantly.

Balancing the advantages and risks of blue-chip stocks is crucial in constructing a well-rounded investment portfolio. Incorporating these stocks while considering their pros and cons can contribute to a diversified and resilient investment strategy.

Blue-chip stocks vs. other investment options

Comparing blue-chip stocks with alternative investment options like growth stocks, value stocks and bonds offer insights into their distinct characteristics and performance dynamics.

Blue-chip stocks

Blue-chip stocks are renowned for stability, consistent dividends and market leadership. They often belong to well-established companies with solid financials and enduring market presence. These stocks typically attract long-term investors seeking reliable income streams and moderate growth potential.

Growth stocks

Growth stocks represent companies with high potential for substantial future growth, often reinvesting earnings into expanding operations. They typically prioritize innovation and expansion over dividend payments. While growth stocks offer the potential for higher returns, they are also associated with higher volatility and greater risk.

Value stocks

Value stocks are undervalued companies, often overlooked by the market, trading at prices lower than their intrinsic value. Investors seek value stocks based on the belief that the market has undervalued these companies, offering the potential for capital appreciation once their value is recognized.

Bonds

Bonds are debt instruments issued by governments or corporations, offering fixed interest payments over a specified period. They are considered safer investments than stocks, providing steady income but typically yielding lower returns compared to stocks.

Performance comparison and considerations

Blue-chip stocks tend to outperform where stability and consistent dividends are paramount. During economic downturns or uncertain market conditions, the reliability of blue-chip stocks may offer a cushion against volatility, outperforming growth stocks.

However, growth stocks may outshine blue-chip stocks in strong market upswings due to their potential for higher growth rates. They often appeal to investors seeking aggressive growth and are more suitable for those willing to take on higher levels of risk.

Value stocks, similar to blue-chip stocks, focus on stability but offer potential for capital appreciation once the market recognizes their true value. Bonds, on the other hand, provide stability and income but with a lower potential for capital growth.

Considerations for investors

- Risk tolerance: Assess your risk tolerance and investment goals. Blue-chip stocks suit risk-averse investors seeking stability, while growth stocks may appeal to those comfortable with accepting a higher risk for potentially higher returns.

- Diversification: Create a balanced portfolio by diversifying across various asset classes. A mix of blue-chip stocks, growth stocks, value stocks and bonds can help spread risk and optimize returns.

- Investment horizon: Align your investment horizon with the characteristics of each investment type. Blue-chip stocks are suited for long-term investments, while growth stocks may be more suitable for shorter investment horizons.

Considering the characteristics and performance of different investment options is crucial in crafting a well-diversified portfolio that aligns with your risk appetite, investment goals and time horizon.

The enduring allure of blue-chip stocks

Investing in blue-chip stocks is an investment strategy rooted in stability, reliability and calculated growth. Our examination of blue-chip investments is a testament to the appeal of established companies with robust financials, enduring market presence and consistent dividends. Blue-chip stocks are the epitome of reliability in a fluctuating market terrain, attracting investors seeking a sanctuary of stability amidst market fluctuations.

The allure of blue-chip stocks lies in their resilience, offering a hedge against market volatility and providing a stream of reliable income through consistent dividend payments. However, blue-chip investments are not without their list of considerations. While offering stability, these stocks might limit capital appreciation and susceptibility to economic downturns. In combining blue-chip stocks with other investment options, a balanced portfolio strategy ensures resilience and optimal returns across market fluctuations.

Blue-chip stocks stand as a testament to reliability, offering a sanctuary for those seeking stable returns and a shield against market turbulence. By embracing the calculated balance of risk and stability, these stocks remain integral to crafting a diversified and resilient investment portfolio.