A stock screener can streamline your research process, save valuable time and uncover promising investment opportunities. However, many investors do not fully understand how to use a stock screener or how stock screening can help them find profitable trades.

Whether you want to learn how to use a stock screener for swing trading, how to use a stock screener for day trading or how to screen stocks to find investments that fit your strategy, MarketBeat's stock screener is the best free stock screener to help you.

MarketBeat's free stock screener can help you screen stocks and create profitable stock screening strategies. We'll dive into the intricacies of what stock screens are, how to set up a stock screener, how to read a stock screener and valuable tips for beginners.

What is a Stock Screener?

What is a stock screener, exactly? A stock screener is a robust tool designed to help investors and traders filter through a vast universe of stocks to identify those that meet specific criteria or parameters.

A stock screener is a powerful resource to streamline your investment or trading strategies by narrowing down your options based on desired characteristics. Stock screeners are available in various formats, from free stock market screeners to paid services.

A stock screener allows you to define and apply specific filters to a wide range of stocks. These filters can include fundamental and technical indicators, financial ratios, market capitalization, sector classifications and more. You can refine your search to focus on stocks that align with your investment goals, risk tolerance and trading strategies, whether you're after a day trading stock screener experience or looking into premarket screeners or after hours screeners.

The terms "stock scanner" and "stock screener" are often used interchangeably, although some slight differences may exist between them. When comparing a stock scanner vs screener, generally, a stock scanner refers to a tool that rapidly scans the market in real-time, identifying stocks that meet certain criteria such as price movements, volume or technical patterns. On the other hand, a stock screener provides more extensive filtering options, allowing users to set specific criteria based on a broader range of factors.

Stock scanners for day trading are crucial in identifying potential trade opportunities within short timeframes. Day trade screeners typically offer filters such as volume, price range, average true range (ATR), relative strength index (RSI) and other technical indicators. These filters help day traders identify stocks with high liquidity, significant price volatility and strong intraday momentum suitable for quick trades.

In addition to regular market hours, some stock screeners cater to after-hours trading. After-hour screeners allow traders to scan stocks actively trading outside the usual market session, enabling users to identify stocks with significant price movements or news events outside regular trading hours, providing additional opportunities for traders to capitalize on market fluctuations.

While some stock screeners require a subscription or payment, free options are also available. Some markets provide free screeners. Free stock market screeners typically offer basic filtering capabilities, allowing you to apply standard filters such as price, market capitalization, dividend yield and earnings per share (EPS). While they may offer a different level of customization and advanced features than their paid counterparts, these free screeners can still be valuable for beginners or those on a limited budget. MarketBeat offers a free version of its screener and a paid version with a few more capabilities.

To effectively use a stock screener, understand how to read stock screener data and how to use stock screener data. Reading a stock screener involves comprehending the filters and parameters used to screen stocks. Each screener may have different options for selecting criteria, so clearly understand your investment or trading strategy and the specific factors you consider important.

How Stock Screeners Work

Stock screeners employ sophisticated algorithms and data analysis techniques to filter and sort through a vast universe of stocks based on specific criteria defined by the user. These criteria can include fundamental factors, such as financial ratios, earnings growth and technical indicators, like moving averages and volume patterns.

Stock screeners rely on comprehensive databases that store various financial and market data. These databases aggregate information from various sources, including stock exchanges, financial statements, news sources and market data providers. The data collected typically includes fundamental metrics, historical price and volume data, corporate announcements and industry classifications.

You can define or filter criteria based on your investment or trading strategy. You can broadly categorize these into fundamental and technical factors. Fundamental factors focus on a company's financial health and performance, while technical indicators analyze price and volume patterns to identify trends, momentum and potential reversals.

Once the filter criteria are selected, the stock screener applies them to the entire universe of stocks. The screener evaluates each stock against the defined criteria and eliminates those not meeting the specified thresholds or conditions. The remaining stocks that pass the filters are then sorted based on a selected sorting criterion, such as market capitalization, sector or performance metrics.

The stock screener presents the filtered and sorted results to the user in an organized and easily readable format. The display typically includes a table or list that shows relevant information for each stock, such as the company name, ticker symbol, current price, market capitalization, volume and any other relevant criteria specified during the filtering process.

Some stock screeners provide real-time or near real-time data updates, allowing users to monitor the market and receive instant notifications when new stocks meet their specified criteria. Real-time updates are handy for day traders and active investors who require up-to-date information to make timely trading decisions.

Stock screeners often offer customization options, enabling you to save your preferred filter criteria for future use. This feature allows you to quickly access preferred screens without redefining your criteria each time. Saved screens can be modified and adjusted as needed, allowing for flexibility as market conditions and investment strategies evolve.

Some stock screeners seamlessly integrate with brokerage platforms, allowing you to execute trades directly from the screener interface. Some brokerage platforms also offer a private label stock screener. This integration streamlines the workflow, enabling you to act quickly on the opportunities identified through the screening process.

While stock screeners provide valuable insights and assist in identifying potential investment opportunities, they should not be the sole basis for making investment decisions. Screeners serve as a starting point for further research and analysis. Supplement the information obtained from screeners with in-depth company research, analysis of financial statements, consideration of market trends and evaluation of overall market conditions.

Example of Using a Stock Screener

To provide a practical example of using a stock screener, let's walk through a step-by-step process and model the information for a randomly selected stock. Stock screeners' specific features and layouts may vary, but the general principles remain consistent.

Step 1: Define your investment strategy and criteria.

Before starting the stock screener, you must clearly understand your investment strategy and the specific criteria you're looking for in a stock. For this example, let's assume you are a growth investor seeking stocks with solid earnings per share growth, a low debt-to-equity ratio and a market capitalization above $1 billion.

Step 2: Access the stock screener.

Log in to your preferred stock screener platform. You can choose from various online resources that offer free or paid stock screeners. Once you access the platform, familiarize yourself with the user interface and locate the search or screening functionality.

Step 3: Set filter criteria.

In the stock screener, select the filters that match your defined criteria. Start by setting a filter for earnings per share growth, specifying a minimum growth rate of 20% over the past year. Next, add a filter for the debt-to-equity ratio, setting a maximum threshold of 0.5 to focus on companies with low debt levels. Finally, include a filter for market capitalization, setting a minimum threshold of $2 billion.

Step 4: Apply filters and review results.

Apply the defined filters to the stock universe by clicking the "search" or "apply" button. The stock screener will process the filters and present a list of stocks that meet the specified criteria. From the results list, you can start analyzing the individual stocks looking for the ones that best suit your strategy.

For instance, if you are looking for stocks with a lower price point, you can sort the list by current price and start your analysis that way. In our search for potential investment opportunities, we can narrow our focus by considering specific criteria. Let's assume we are interested in low share prices and at least a "moderate buy" consensus rating. This means we are looking for stocks priced relatively lower than their perceived value and have received a favorable consensus rating from analysts or experts. The preference for low share prices suggests a desire to uncover potential undervalued opportunities or affordable stocks.

Meanwhile, the requirement for a "moderate buy" consensus rating indicates a desire for stocks that have received positive sentiment, albeit not reaching the level of a strong or unanimous recommendation.

By combining these criteria, we aim to identify stocks with attractive pricing and a favorable level of industry expert sentiment, enhancing the potential for successful investment decisions.

Step 5: Analyze individual stock.

We have used our screener to narrow down the thousands of available stocks into a list of just a few. The next step is to do a detailed analysis of each of the stocks on your narrowed-down list to find the ones that best align with your investment strategy. Click on the stock's name or ticker symbol. We will start with PG&E (NYSE: PCG) and access its dedicated page or detailed overview.

PG&E Corporation is a leading energy company serving northern and central California customers. With a rich history dating back to 1905, PG&E's subsidiary, Pacific Gas and Electric Company, delivers electricity and natural gas through diverse energy sources, including nuclear, hydroelectric, fossil fuels, fuel cells and photovoltaic technologies.

In this scenario, as a growth investor analyzing PG&E (NYSE: PCG) stock, it is crucial to examine various aspects to understand the company's potential for growth and market dynamics. Assessing PG&E's profile provides an overview of its operations, including selling and delivering electricity and natural gas to northern and central California customers. This insight helps evaluate the company's market position and growth opportunities within its regions.

Additionally, reviewing PG&E's analyst ratings offers valuable insights into expert perceptions of PG&E's stock. These ratings provide an understanding of market sentiment and analysts' confidence in the company's growth potential. Analyzing PG&E's stock chart helps identify historical price trends, patterns and volatility levels. This information aids in identifying potential support and resistance levels and spotting trends or patterns that may influence investment decisions.

Reviewing PG&E's competitors is another crucial step. Assessing the company's performance, market share and competitive positioning relative to its peers enables investors to understand its growth prospects within the industry.

Furthermore, analyzing PG&E's earnings and PG&E's financials provides an in-depth understanding of its financial health and performance metrics. Key factors to include revenue growth, earnings growth, profit margins and return on equity. These metrics help assess the company's ability to generate sustainable growth.

Examining PG&E's insider trades and PG&E's institutional ownership reveals insights into the actions and sentiments of company insiders and institutional investors. Significant insider trades or high institutional ownership can indicate confidence or concerns about the company's growth potential.

Keeping track of headlines and news related to PG&E is vital for understanding any significant developments or events that may impact the company's growth trajectory. This includes monitoring regulatory changes, industry trends or major announcements affecting PG&E and its operations.

Analyzing the options chain and SEC filings can provide additional information. PG&E's options chain reflects market expectations and sentiment, while PG&E's SEC filings offer detailed financial and operational disclosures required by regulatory authorities.

Assessing PG&E's short interest provides insights into market sentiment and bearishness or skepticism surrounding PG&E stock. High short interest may indicate concerns or negative expectations regarding the company's growth prospects.

Lastly, monitoring PG&E's social media sentiment can offer insights into the trending media sentiment and discussions among retail investors and the wider investing community. While it should be considered cautiously, social media sentiment can provide additional perspectives on PG&E's growth potential.

Conduct fundamental analysis on PG&E (NYSE: PCG). Evaluate its financial ratios, such as price-to-earnings ratio (P/E ratio), price-to-sales ratio (P/S ratio), return on equity (ROE) and other relevant metrics. Compare these ratios to industry benchmarks and historical performance to assess the stock's valuation and financial health.

Step 8: Consider technical indicators.

Review the PG&E (NYSE: PCG) price chart and relevant technical indicators if you incorporate technical analysis. Analyze moving averages, trendlines, volume patterns and other indicators that align with your trading strategy.

Step 9: Conduct further research.

Conduct additional research beyond the stock screener's data to make an informed investment decision. Read the PG&E (NYSE: PCG) latest financial reports, review earnings calls transcripts and explore independent research reports. Consider macroeconomic factors, industry trends and potential risks impacting the company's future performance.

Step 10: Make an investment decision.

Based on your comprehensive analysis, decide whether to invest in PG&E (NYSE: PCG). Consider the alignment of the stock's characteristics with your investment strategy, risk tolerance and overall portfolio diversification. Execute the investment through your preferred brokerage platform if you decide to proceed.

This example demonstrates how a stock screener can filter and analyze stocks based on specific criteria. You can make informed investment decisions that align with your objectives and risk appetite by conducting thorough research and analysis. Remember that stock screeners are just tools, and prudent investment decisions require ongoing monitoring and adaptation to market conditions.

How to Use MarketBeat's Stock Screener

MarketBeat offers a powerful free stock screener tool that can assist investors in filtering and identifying potential investment opportunities. Let's take a step-by-step walkthrough of the screener from an investor's perspective.

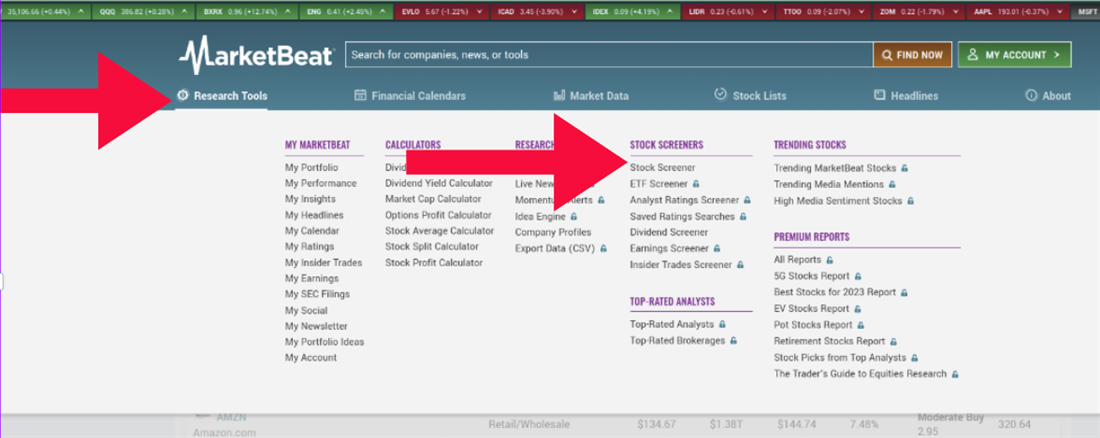

Step 1: Access the stock screener.

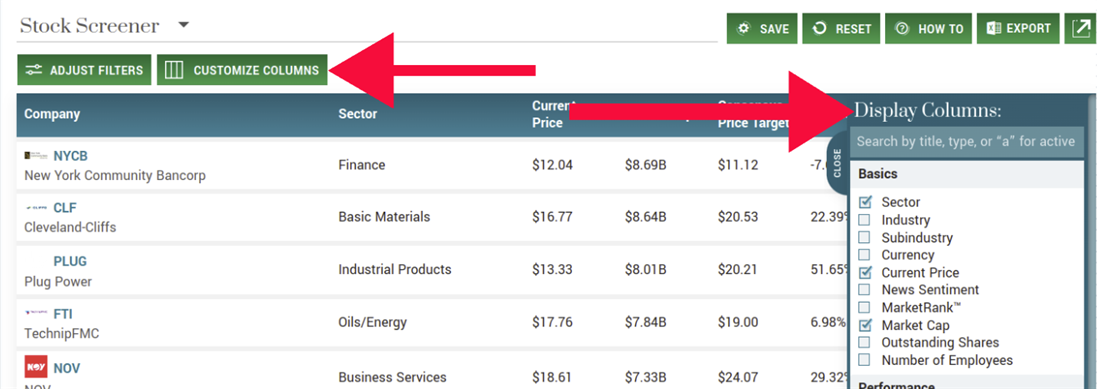

Visit the MarketBeat website and navigate to "stock screener" on the research tools menu and MarketBeat's Research Tools page. Once you have reached the screener page, you will notice at the top options to save your screener, reset your current screener or export your screener data to a spreadsheet for further analysis. Also note the "adjust filters" and "customize columns" buttons. These buttons allow you to define and adjust your filter criteria.

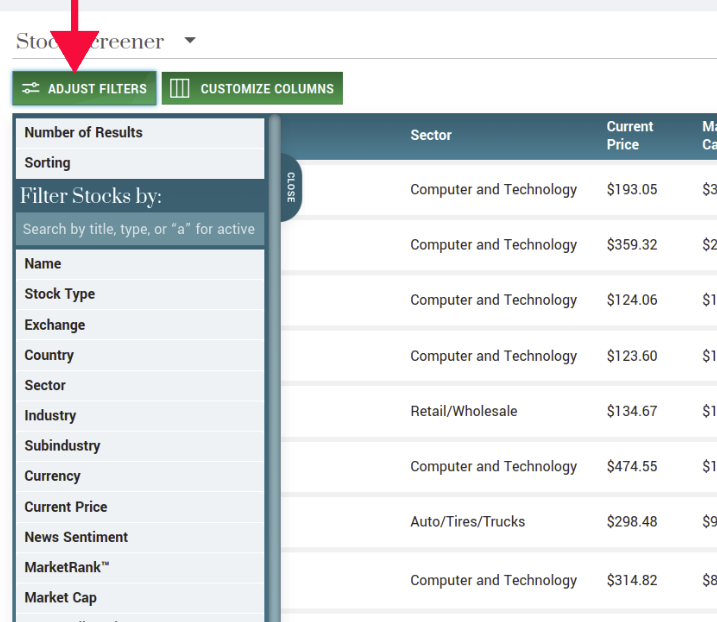

Step 2: Define filter criteria.

Step 2: Define filter criteria.

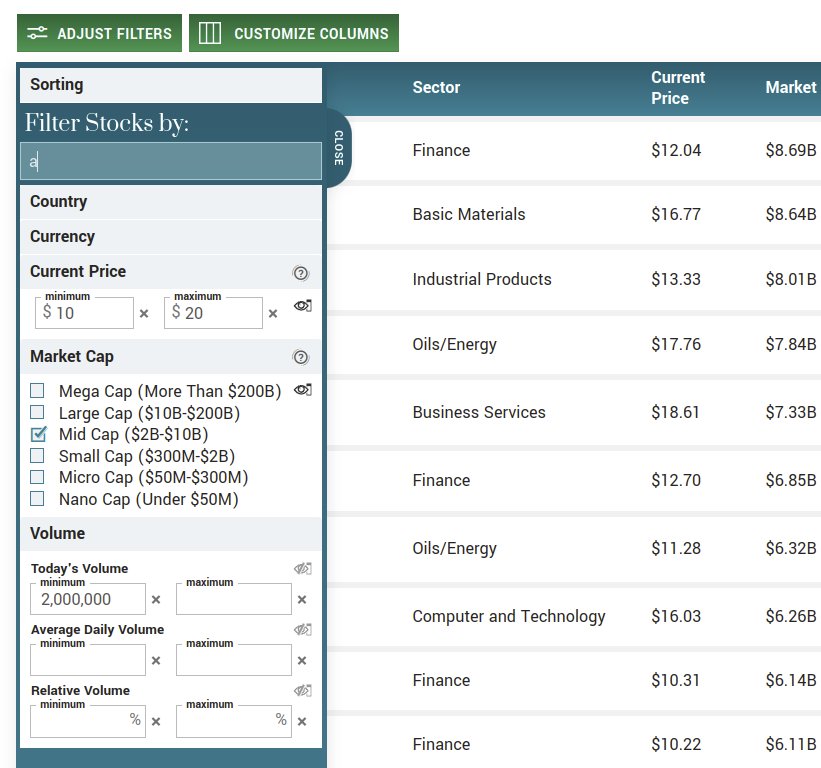

Once on the stock screener page, you can adjust the filters by clicking the "adjust filters" button, which will bring up the filters menu. Begin by defining your filter criteria based on your investment strategy and preferences. MarketBeat's stock screener offers a wide range of filter categories, including market capitalization, industry, price, volume, dividend yield and more.

MarketBeat included a search feature to find the best filter for your requirements. Once you have set up your filters, searching "A" will conveniently allow you to see and modify your active filters to refine your strategy further.

Step 3: Select filter parameters.

You can set specific parameters within each filter category that align with your investment criteria. For example, if you are looking for stocks with a market capitalization between $2 billion and $10 billion, you can set the appropriate range in the "market cap" filter.

Similarly, you can specify minimum and maximum values for filters like price, volume, dividend yield, and various financial ratios. As you select the filter parameters, the list of companies that fit your screener will continually update. When you change a filter setting, MarketBeat's stock screener will process the filters and generate a list of stocks meeting your criteria.

Step 4: Review results and customize columns.

Once the results are displayed, you can review the list of stocks that passed the filters. MarketBeat's stock screener presents the results in a table format with relevant information for each stock, such as the company name, ticker symbol, current price, market cap, dividend yield and other financial metrics.

To further customize the information displayed, you can select the columns you want to see by clicking on the "customize columns" or similar option, allowing you to tailor the table to display the data points most relevant to your investment analysis.

Step 5: Sort and rank results.

MarketBeat's stock screener allows you to sort and rank the filtered results based on specific criteria. The display columns menu appears when you click on the "customize columns" button.

Inside this menu are many data points you can utilize within the screener. Sorting by sector, current price, market cap, debt ratios, volume and more is as simple as adding a column for the data point you wish to track. You can click on the column headers to sort the list in ascending or descending order. For example, you can sort the results by dividend yield, price-to-earnings ratio or any other column that helps your investment decision-making process.

Step 6: Save and export results.

If you are a MarketBeat All-Access member, MarketBeat's stock screener provides options to save and download your filtered results for future reference. You can create a custom list or watchlist to monitor the stocks that match your criteria. The platform offers the ability to export the results as a spreadsheet (.csv) file for further analysis offline.

Step 7: Conduct further research.

While the stock screener is a valuable starting point, conduct thorough research and analysis on the selected stocks. Dive deeper into individual companies by reviewing their profiles, financial statements, news, analyst ratings and other relevant information on MarketBeat or other trusted sources.

MarketBeat's stock screener is a versatile tool that helps streamline the process of identifying potential investment opportunities. However, using the results as a starting point for further research and analysis is important to make well-informed investment decisions.

How to Customize Your Screening

Customization is a key aspect of utilizing a stock screener effectively. You can efficiently identify stocks that align with your preferred strategies by tailoring the filters and criteria to match specific trading methodologies.

Day Trading

Day traders aim to profit from short-term price fluctuations. When using a stock screener, day traders can customize filters to identify stocks with high liquidity, volatility and short-term momentum, including filters for average daily volume, percentage price change, relative strength index (RSI) and volume spikes. By using these criteria, day traders can efficiently identify stocks with the potential for quick intraday price movements.

Swing Trading

Swing traders seek to capture short- to medium-term price movements. Customizing a stock screener for swing trading involves filters identifying stocks with strong trends, potential breakouts and favorable risk-reward ratios. Traders can utilize filters like moving average crossovers, chart patterns (like ascending triangles or bull flags) and volatility measures (like average true range) to identify swing trading opportunities with reasonable profit potential and defined entry and exit points.

Growth Trading

Growth traders focus on identifying stocks with significant growth potential over an extended period. When customizing a stock screener for growth trading, filters can prioritize revenue growth, earnings growth and future growth expectations. Metrics such as historical and projected earnings per share (EPS) growth rates, revenue growth rates, return on equity (ROE) and industry-specific growth indicators can assist in identifying stocks with strong growth prospects.

Value Investing

Value investors seek undervalued stocks with the potential for long-term appreciation. Customizing a stock screener for value investing involves filters related to valuation ratios (e.g., price-to-earnings, price-to-book), dividend yield and solid financials. By setting these filters, investors can identify stocks potentially trading at a discount to their intrinsic value, indicating an opportunity for long-term capital appreciation.

Dividend Investing

Dividend investing strategy focuses on stocks that provide regular income through dividends. When customizing a stock screener for dividend investing, filters related to dividend yield, dividend growth and payout ratios are essential.

Identifying stocks with consistent dividend payments, increasing dividend yields over time and sustainable cash flows helps you find stocks suitable for generating regular income. If making income is one of your goals, learning the dividend capture strategy is a great place to start your investment journey.

Momentum Trading

Momentum traders aim to capitalize on stocks experiencing strong price movements. When using a stock screener, momentum traders can customize filters to identify stocks with high relative strength, trending indicators (like moving averages or MACD) and volume surges indicating strong buying or selling pressure. These filters assist in finding stocks with the potential for short-term price momentum.

Income Investing

Income investors focus on generating regular income from their investments. Customizing a stock screener for income investing involves:

- Filters for prioritizing dividend yield

- Interest rate sensitivity

- Payout ratios

- Cash flow stability or bond coupon payments

By setting these filters, investors can identify stocks or bonds that offer attractive income-generating potential.

By customizing a stock screener to align with these various trading strategies, you can efficiently identify stocks that match your specific approach. The flexibility and versatility of stock screeners allow for customization, enabling traders, in particular, to filter and identify potential investment opportunities that align with their preferred trading methodologies.

Stock Screener Tips for Beginners

Before using a stock screener, clearly define your investment goals and strategy. Determine whether you seek growth, value, income or a combination of these objectives. Understanding your investment goals will help you focus on the appropriate filters and criteria when customizing your stock screener.

When beginning with a stock screener, it's advisable to start with basic filters such as market capitalization, industry and price range to help narrow the universe of stocks. It provides a foundation for further customization based on your preferences and investment approach.

Learn about the available filters and their functionalities within the stock screener. Experiment with different combinations of filters to see how they impact the results. This hands-on exploration will help you understand how different criteria influence the displayed stocks.

Refine your filters gradually rather than overwhelming yourself with too many criteria. Start with a few relevant filters to your investment strategy and gradually add or modify filters based on your evolving understanding and experience.

Stock screeners often allow customization of time frames, enabling you to filter stocks based on different periods, such as one year, six months or three months. When evaluating potential investments, consider utilizing multiple time frames to assess long- and short-term dynamics.

Market conditions and stock dynamics can change rapidly. Stay informed by following market news, updates and industry trends. Knowing the broader market environment will help you make more informed decisions and adapt your stock screener filters accordingly.

Take advantage of educational resources provided by the stock screener, MarketBeat's platform or other reputable sources. Consider creating a watchlist within the stock screener to track and monitor the stocks that meet your criteria. Observe the performance of filtered stocks over time, evaluate the trends and make informed investment decisions.

By following these tips, beginners can maximize the benefits of stock screeners and navigate the vast universe of stocks more effectively. As you gain experience and familiarity with the tool, you can continue to refine your filters and adapt your screening approach to align with your evolving investment goals and strategies.

Pros and Cons of Stock Screeners

Stock screeners offer a range of benefits for potential investment opportunities. However, like any tool, stock screeners have both advantages and disadvantages.

Pros of Stock Screeners

Here are some key benefits of using stock screeners:

- Time efficiency: Stock screeners save valuable time by automating the process of filtering stocks based on specific criteria. Rather than manually scanning through many stocks, screeners allow users to set filters and quickly generate a list of stocks that match their desired criteria.

- Customization: Stock screeners offer extensive customization options, allowing users to tailor the filters and criteria to their specific investment goals and strategies. This flexibility enables investors to focus on stocks that align with their preferred criteria, such as market capitalization, industry, financial ratios, growth rates or dividend yield.

- Objective analysis: Stock screeners provide an objective approach to analyzing stocks, relying on predefined criteria rather than personal biases or emotions. This helps investors avoid potential biases and ensures a more systematic and data-driven investment decision-making process.

- Wide coverage: Stock screeners typically cover a broad range of stocks across different exchanges, sectors and markets. This expansive coverage allows users to explore opportunities beyond their immediate knowledge or areas of expertise, expanding their investment horizons.

- Screening efficiency: With the ability to apply multiple filters simultaneously, stock screeners allow you to conduct advanced screenings and narrow your focus to a manageable list of stocks. This enhances the efficiency of the investment research process and assists in identifying stocks that meet specific investment criteria.

- Idea generation: Stock screeners can be valuable for generating investment ideas. By utilizing predefined screens or exploring popular screening strategies, you can discover stocks that match established investment philosophies or uncover new opportunities in sectors or industries that you may not have considered otherwise.

Cons of Stock Screeners

While stock screeners offer notable advantages, it is essential to be aware of their limitations and potential drawbacks. Here are some key considerations regarding the cons of using stock screeners:

- Oversimplification: Stock screeners employ predefined filters and criteria, which may oversimplify the complex nature of investment analysis. By focusing solely on quantitative factors, screeners may overlook qualitative aspects such as management quality, industry trends or macroeconomic factors, which can significantly impact a company's performance.

- Lack of context: Stock screeners provide filtered lists of stocks based on specific criteria but may not provide the necessary context or detailed information about each stock. Additional research and analysis are often required to fully evaluate a stock's potential, including fundamental analysis, reading financial statements and staying updated on relevant news and events.

- Limited scope: While stock screeners cover a wide range of stocks, they may have limitations regarding data accuracy, coverage of small-cap or international stocks or access to real-time information. Investors should be mindful of these limitations and conduct additional research to validate and complement the data provided by the screeners.

- Neglecting market timing: Stock screeners focus on identifying stocks that meet specific criteria but may not consider broader market conditions or timing. Investors must consider the overall market environment, economic factors and potential timing considerations when making investment decisions, which may require additional analysis beyond the scope of stock screeners.

- Potential overreliance: Relying solely on stock screeners without conducting thorough research or due diligence can lead to an overreliance on the tool's output. Validate and supplement the screener results with comprehensive analysis and an understanding of the underlying businesses and industries.

Investing Made Smarter with Screeners

With the right understanding and disciplined approach, stock screeners can be valuable tools for navigating the stock market, unlocking hidden opportunities and making informed investment decisions.

By combining the power of stock screeners with thorough research and market awareness, you can strive for greater success in your investment endeavors.

FAQs

You may still have questions about these tools' best practices and functionality. Let's address some frequently asked questions to provide clarity and insights into the most commonly asked questions about stock screeners.

What is the best way to screen for stocks?

The best way to screen for stocks depends on your investment goals and strategy. Start by defining your criteria, such as market capitalization, industry, financial ratios or growth rates. Utilize a stock screener offering customization options to tailor the filters to your requirements. Experiment with different combinations of filters and regularly review and refine your criteria as needed.

When should you scan stocks?

The frequency of scanning stocks depends on your investment approach and the time horizon of your trades. Active day traders may scan stocks multiple times throughout the trading day, while swing traders may perform scans daily or weekly.

Long-term investors may opt for less frequent scans, focusing on fundamental factors and periodic portfolio reviews. Ultimately, the frequency of scanning stocks should align with your trading or investing strategy and your desired level of involvement in the market.

How does a screener work?

A stock screener is a software tool that filters stocks based on specific criteria or parameters. When using a screener, input your desired filters, such as price range, market capitalization, industry, financial metrics or technical indicators. The screener then scans the available universe of stocks and presents a list of stocks that match the specified criteria. This process allows you to narrow your focus and identify potential investment opportunities more efficiently.